According to a Bloomberg report, the success chalked by Ghana is because of friendlier policies, lower-cost mines and new development projects.

The report indicated that South Africa’s dwindling gold production is due to high costs, regular strikes and geological challenges of tapping the world’s deepest mines.

It also stated that South African industry stalwarts AngloGold Ashanti Ltd. and Gold Fields Ltd. are also shifting their focus to other countries, including Ghana, where deposits are cheaper and easier to mine; adding that the largest remaining gold miner in South Africa, Sibanye Gold Ltd., is cutting thousands of jobs and diversifying into platinum-group metals as it struggles to contain costs.

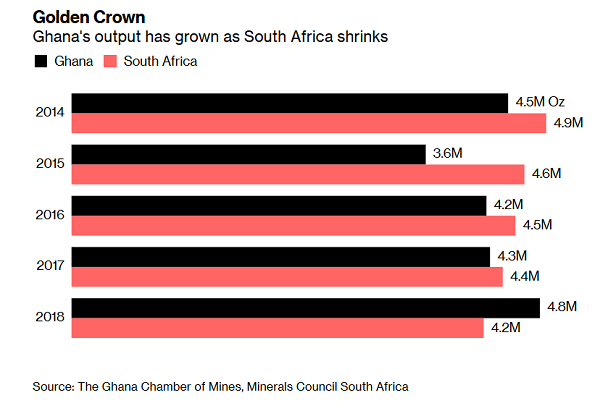

Golden Share

Citing figures from the Ghana Chamber of Mines and the Minerals Council of South Africa, the report said Ghana produced 4.8 million ounces of gold in 2018 as opposed to South Africa’s 4.2 million ounces.

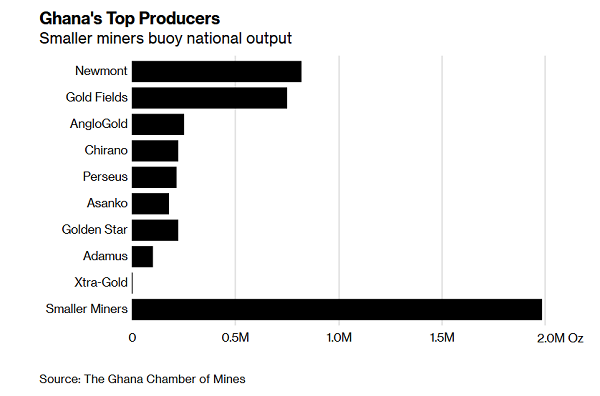

According to Ghana’s Chamber of Mines, gold output jumped to 12 per cent, with small producers accounting for the largest share of the total.

The report further noted that Ghana’s gold output will get a further boost when AngloGold Ashanti’s Obuasi operation, previously overrun by illegal miners, restarts later this year. Production from Obuasi is forecast at 350,000 to 450,000 ounces of gold annually during the first 10 years.