The Bank of Ghana (BoG) has praised the relative calm in the foreign exchange market on the strong reserves accumulated over the period.

It has also pledged to boost the reserves further to help provide more buffer to the cedi against the major foreign currencies.

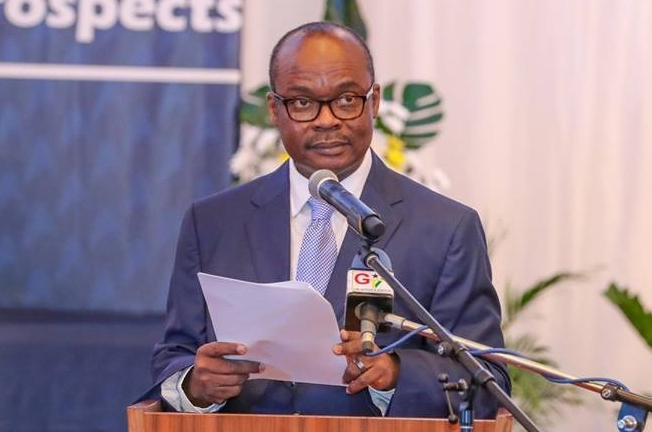

At a press conference that maintained the bank’s benchmark rate at 14.5 per cent on July 27, the Governor of BoG, Dr Ernest Addison, said the bank aimed to add a minimum of US$300 million to the reserves before the end of the year.

When successful, the additional funds should shore up the country’s gross international reserves to US$9.5 billion, equivalent to almost more than 4.5 months of import cover.

The governor was responding to questions on how the bank intended to maintain the current stability in the foreign exchange market ahead of the December 7 general election.

Strong reserves

Dr Addison said the bank had used the country’s recent borrowings from the Eurobond market, the World Bank and the US$1 billion credit from the International Monetary Fund (IMF) to shore up its reserves to about US$9.2 billion as of June.

In spite of the comforting nature of the reserves, he said BoG was still committed to increasing the figure through new measures that would yield results by the close of the year.

He said the measures were broadly anchored on the country’s export receipts, savings to be made on outflows of funds and expected gains from the application of central bank tools on the external sector.

Cedi performance

The assurance from the BoG to build up more reserves comes at a time when the cedi is enjoying some relative stability.

Data from the bank showed that the cedi had lost about 2.3 per cent of its value to the US dollar as of July 23 this year, compared to 8.3 per cent in the same period last year.

It also lost 5.6 per cent to the euro compared to 7.9 per cent in the same period last year.

Against the British Pound, the data showed that the cedi had gained 1.2 per cent as of July 23 this year, compared to the same period last year when it lost 7.6 per cent.

Dr Addison said those developments were encouraging and the bank would work to consolidate them.

Reasons for policy rate decision

Earlier, the governor had explained that the Monetary Policy Committee, which he chaired, decided to maintain the policy rate at 14.5 per cent due to the peculiar nature of the current circumstances.

“The committee was of the view that the current extraordinary circumstances, with a widened budget deficit and a residual financing gap, would require some monetary restraint to preserve the anchors of macroeconomic stability,” he said.

On July 23, the Minister of Finance, Mr Ken Ofori-Atta, said the government had revised its budget target for the year from 4.7 per cent of gross domestic product to 11.4 per cent on the back of lagging revenues and the increasing need to spend to contain the raging coronavirus disease and its impact on the economy.

Dr Addison said although the deficit target was exceptionally high, it was necessary to help fight the virus.

“The committee noted that the COVID-19 pandemic had pushed public finances out of the path of fiscal consolidation.

“The huge financing gap brought about by the expanded deficit could exert pressure on public debt, with long-term implications for the economy,” he said.

He noted that: “While the government’s stimulus package for various sectors of the economy, including micro, small and medium-sized enterprises is in the right direction to boost economic activity, the committee’s view is that going forward, the 2021 budget should be focused on instituting measures to return to the fiscal consolidation path, with the view to building resilience and strengthening the pillars of the economy for a return to macroeconomic stability. ”