Patrick Loch Otieno Lumumba, renowned Pan Africanist, African Law Professor, and Founder of the P.L.O.Lumumba Foundation, is concerned about African leaders’ continuing reliance on the Bretton Woods Institutions, the International Monetary Fund (IMF) and the World Bank.

He claims that when these institutions’ executives sit down, they tell themselves that African presidents are incapable of managing their business efficiently.

“When they sit at the IMF and World Bank or European Union when Africans are not there, what do they say, we told you they are incapable of managing their affairs,” Prof Lumumba told TV3’s Alfred Ocansey in a yet-to-be-aired interview on the Ghana Tonight show on Thursday February23.

Ghana is currently attempting to reach an agreement with the IMF to help the oil-producing West African country deal with economic issues.

The government and the Fund have reached an agreement at the staff level on a new programme.

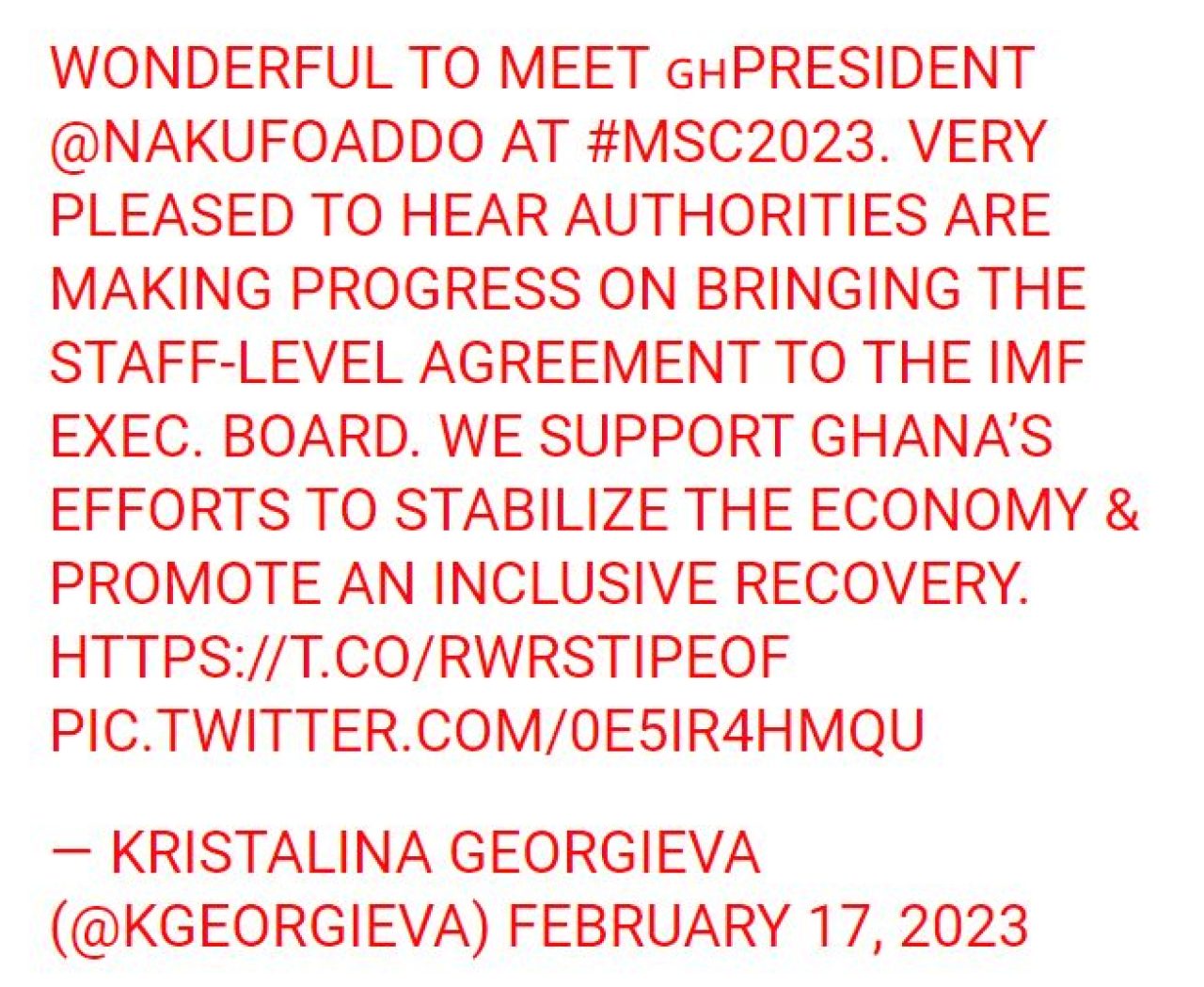

Kristalina Georgieva, Managing Director of the IMF, expressed satisfaction with Ghana’s efforts in presenting the staff-level agreement to the Board.

She stated that the IMF backs Ghana’s efforts to stabilize the economy and foster inclusive growth.

In a tweet, she said “Wonderful to meet President @NAkufoAddo at #MSC2023. Very pleased to hear authorities are making progress on bringing the staff-level agreement to the IMF Exec. Board. We support Ghana’s efforts to stabilize the economy & promote an inclusive recovery.”

The staff-level agreement with Ghana is for a three-year programme financed by a $3 billion Extended Credit Facility (ECF) arrangement.

The approval of IMF management and the Executive Board in the coming term is conditional on securing finance assurances from Ghana’s partners and creditors, according to the IMF Chief while answering questions in the press. Questions about Ghana that are frequently asked.

The government’s economic policy is to restore macroeconomic stability and debt sustainability while safeguarding the weak, maintaining financial stability, and building the groundwork for a strong and inclusive recovery.

The authorities have undertaken a comprehensive debt operation to assist the goal of restoring public debt sustainability.

As part of his attempts to secure the agreement, Finance Minister Ken Ofori-Atta updated Parliament on the status of the Domestic Debt Exchange Plan (DDEP).

He encouraged MPs to help the government in obtaining IMF board approval to ensure economic stability.

On Thursday, February 16, Mr. Ofori-Atta informed the House that an IMF agreement would assist Ghana recover rapidly from its economic issues.

“We will recover from this crisis soon rather than later as indicated by President Akufo-Addo.

“I will urge Members of Parliament to support the government to secure the board approval for macro stability.”

Ghana’s fiscal and debt vulnerabilities grew rapidly in the face of an increasingly difficult external environment. Ghana’s governmental debt soared considerably during the COVID-19 pandemic.

At the same time, investors viewed the government’s efforts to maintain debt sustainability as insufficient, resulting in credit rating downgrades, the exodus of non-resident investors from the domestic bond market, and, ultimately, Ghana’s loss of access to international capital markets.

According to the IMF, these negative developments, compounded by price and supply-chain shocks from the Ukrainian war, have resulted in a substantial exchange rate depreciation, a jump in inflation (40.4 percent year on year in October), and pressure on foreign exchange reserves. In light of this, the administration requested IMF help in early summer, and a staff-level agreement was obtained in December 2022.

The programme will assist Ghana in implementing policies that restore macroeconomic stability and maintain debt sustainability while safeguarding the country’s most vulnerable citizens.

It would contribute to the creation of circumstances for inclusive and sustainable growth as well as employment creation. A similar initiative would also assist to reduce exchange rate pressures and act as a catalyst for fresh sources of finance, the authors argue.