Kenya’s failure to pay the March salary of civil officials on schedule indicates a liquidity constraint for a government dealing with unheard-of financial obligations.

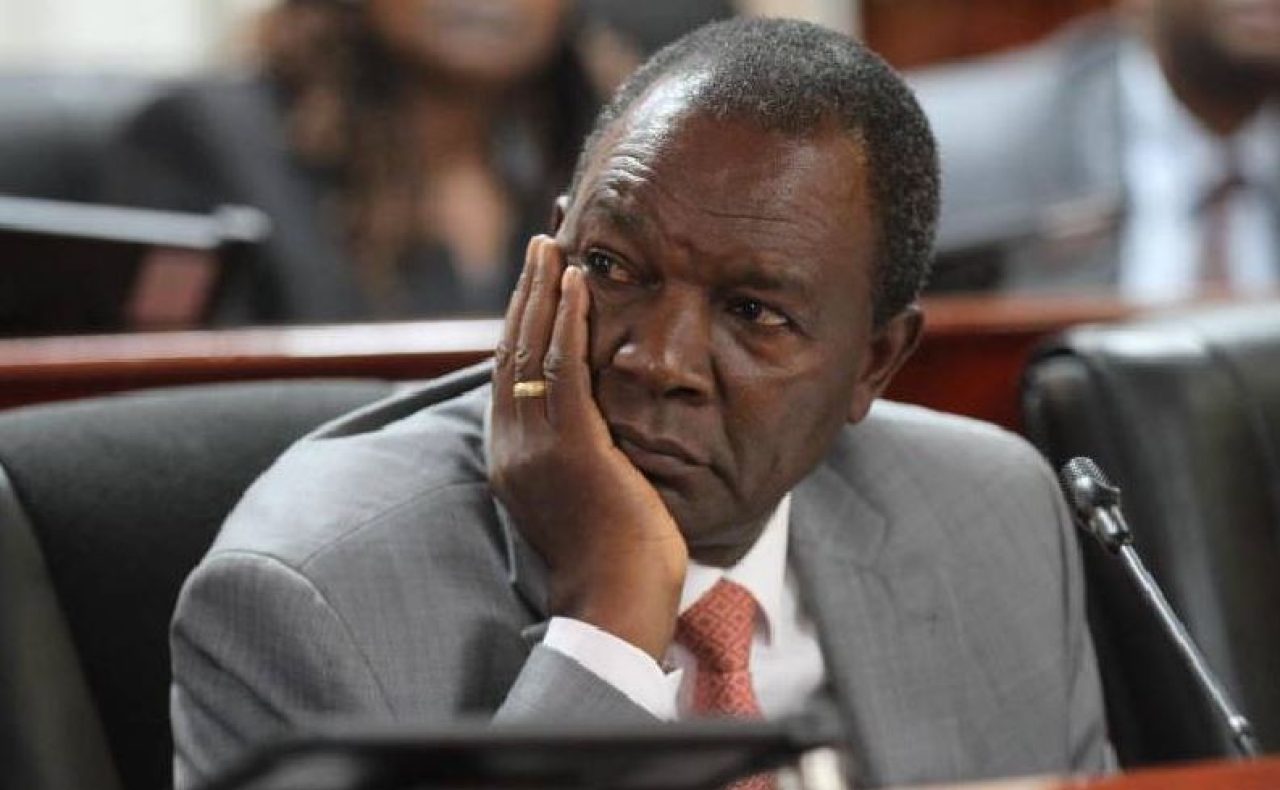

According to David Ndii, senior economic adviser to President William Ruto, the payments will likely be made by the government of the East African country the next week.

Ndii stated on Citizen Television on Monday that tax collection is expected to increase and that the government anticipates receiving roughly $200 million through a syndicated loan.

A National Treasury spokeswoman stated last month that the process of forming a bank syndicate is well along.

Ndii made an effort to allay concerns about a catastrophe by attributing the cash crunch to big domestic debt maturities in March that forced the government to pay creditors nearly 150 billion shillings ($1.1 billion), which is roughly double the amount that’s typically paid.

Furthermore, he added, “you have two corporate income taxes that are paid” in April, referring to the final payment for the fiscal year that ends in June and an installment for the first quarter.

Government employees’ financial suffering is getting worse as the country struggles with a high cost of living. March saw annual inflation of 9.2%, which has been above the central bank’s goal range of 2.5% to 7.5% since June as a result of increased food and energy costs.

According to the state’s Salaries and Renumeration Commission, Kenya’s expected public wage bill for the three months ending in December would be 131.9 billion shillings, up from 123.7 billion shillings a year earlier.

From 923,100 in the prior period to 963,200 in the fiscal year through June, more people were employed in the public sector.

According to figures from the central bank, Kenya’s national debt increased 11.1% to 9.15 trillion shillings at the end of December. According to National Treasury estimates, debt-service expenses in 2023–2024 could reach a record 1.67 trillion shillings.

“It is true we are having challenges in paying salaries,” Deputy President Rigathi Gachagua said Sunday, adding that the government hadn’t disbursed funds, as required, to county administrations. “What we had collected the last two weeks was sufficient to pay the loans.”